Managing Money For Today

4 min read

Your Journey to a More Secure Financial Future Begins Today

by Travis Marks, CFP®, CFA®

Pension Boards-United Church of Christ, Inc.

Financial Wellness for Ministry & Life

A PBUCC Ministerial Resource Pilot

You answered a call to serve. Now it’s time to plan with purpose.

Ministry is a life of deep commitment, but it often comes with financial uncertainty. Whether you’re just beginning your journey or approaching retirement, seeking financial guidance isn’t just wise—it’s an act of faithful stewardship. By learning to manage money intentionally today, plan ahead for your future needs, and save for tomorrow, you can build a strong foundation that supports both your calling and your wellbeing.

Because of ministry, PBUCC is committed to investing in a strong foundation for people of call like you. You deserve the space and grace to focus on leading your church organization’s mission and nurturing a thriving community. As your partner in ministry, we have designed a pilot based on years of experience working with ministers and lay persons across the UCC.

Now, PBUCC invites you to take the next step toward greater financial security. The Financial Wellness for Ministry & Life pilot is designed to help you assess your current situation—including your challenges and priorities—and offers personalized support and guidance. Our goal is to help you make the most of the counseling and solutions available to you as part of your UCC ministry.

Whether you’re looking to pay down debt, build an emergency fund, save for retirement, or protect your loved ones, you’ll find complimentary tools and resources tailored to support you where you need it most.

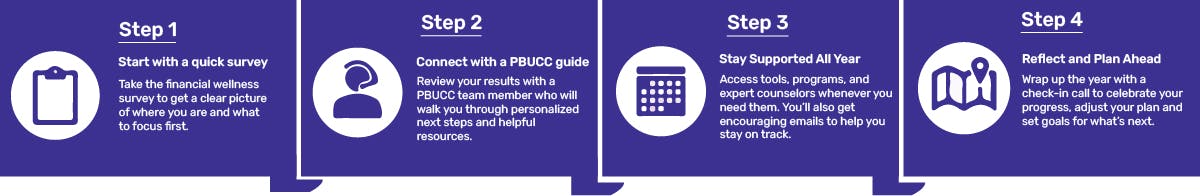

Step 1: Start with a Quick Survey

Discover where you are—and where to begin.

Take the Financial Wellness Survey to get a clear picture of your current financial situation and identify your top priorities.

“I spent a long time in denial about my personal financial reality.”

—Rev. Laura Folkwein, MSW, Pilgrim Congregational UCC, Bozeman, Montana

Step 2: Connect with a PBUCC Guide

You don’t have to do this alone.

Review your survey results with a PBUCC team member who will walk you through personalized next steps and helpful resources.

“The best way to eat an elephant is one bite at a time.”

—Rev. Laura Folkwein

Step 3: Stay Supported All Year

Ongoing encouragement makes all the difference.

Access tools, programs, and expert counselors whenever you need them. You’ll also receive encouraging emails to help you stay on track.

“Relationships and cheerleaders really help motivate me. Find somebody who can be that for you.”

—Rev. Laura Folkwein

Step 4: Reflect and Plan Ahead

Celebrate your progress and prepare for what’s next.

Wrap up the year with a check-in call to reflect on your journey, adjust your plan, and set new goals.

“It is imperative that in seasons of change, clergy be prepared both economically and emotionally.”

—Rev. Michael Sloan, First Congregational Church of Spencerport, New York

Financial wellness is a journey, not a destination. At PBUCC, we believe that caring for your financial future is part of caring for your ministry. This pilot was created to walk with you—step by step—with compassion, clarity, and practical support. Whether you’re facing uncertainty or simply want to be more intentional, we’re here to help you build a future that reflects your values and supports your calling.

Let’s take the next step—together.

Your calling deserves a strong foundation.

Join other UCC ministers who are investing in their future. Take the first step toward clarity, confidence, and peace of mind.

by Travis Marks, CFP®, CFA®

Travis Marks, CFP®, CFA®, is the Director of Generations University for the Pension Boards, responsible for the education initiatives for Pension Boards members, employers, and internal staff. Prior to joining the Pension Boards, Travis worked as Senior Manager of the National Financial Education Practice (FEP) for PricewaterhouseCoopers. He has more than 16 years of financial planning, education, and management experience, and has a passion for helping people improve their finances.

January is the time of year when many of us make New Year's resolutions to make our lives better... resolve this year to increase your financial wellness or improve your financial situation in some way.Elaina Johannessen

LSS Financial Counseling

RELATED ARTICLES

Financial Capability for People of Call: Essential Tips and Resources for Financial Wellness

Protecting Your Financial Future at PBUCC

POPULAR RESOURCES

Budgeting Worksheet

A cash flow budget is all about tracking the timing of your income and expenses to make sure you have enough from week to week.

Setting SMART Financial Goals

Setting financial goals can motivate you to save money. When these goals are SMART, you’re more likely to achieve them.