Faith & Finance

7 min read

What is Responsible Investing at the Pension Boards?

by Minoti Dhanaraj

Director of Responsible Investing, PBUCC

Integrating Your UCC Values for Our World

Responsible investing, also referred to sustainable investing or ethical investing, has seen significant growth as investors increasingly recognize its long-term benefits. More than three quarters (77%) of individual investors globally say they are interested in investing in companies or funds that aim to achieve market-rate financial returns while also considering positive social and/or environmental impact, according to a report from Morgan Stanley.

Why is this important to note?

Responsible investing is an accessible way for the average investor to use their financial power to build a better world while pursuing their financial or retirement goals.

The Pension Boards has long managed retirement assets on your behalf, integrating your financial goals with the United Church of Christ (UCC) values you care about. Through our investments, our goal is to reduce risks associated with poor corporate behavior, promote long-term sustainability and societal impact, influence positive change that impacts our climate, while working to achieve competitive returns—all benefits of responsible investing.

Our investment decisions, made at the intersection of faith and finance, intend to “do good” for creation and humankind, while “doing well” with financial performance for you and our faith communities. When making investment decisions, this faith and finance approach considers the environmental, social, and governance (ESG) issues impacting your investments for the benefit of creating a just world for all.

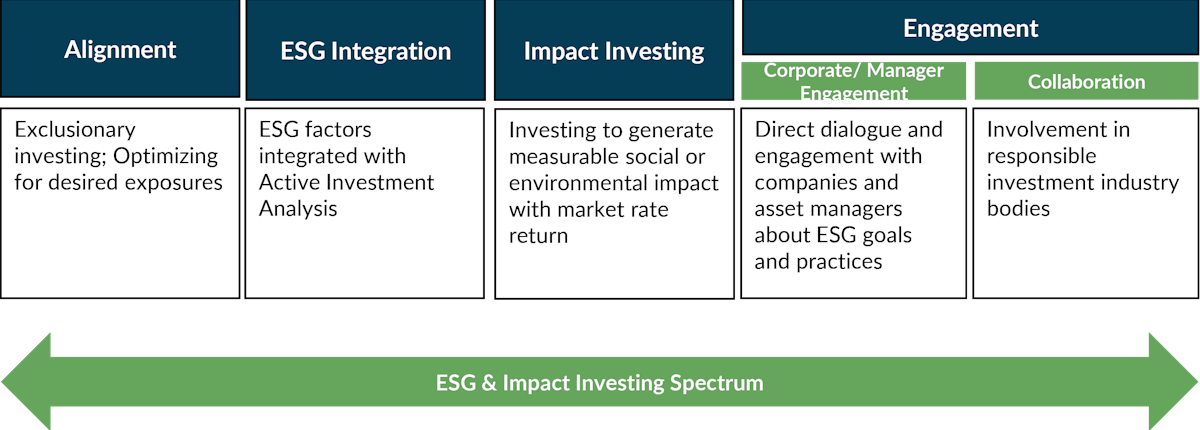

As investors across the world recognize the materiality of social and climate change risks and opportunities within their portfolios of investments, the Pension Boards has taken steps towards managing these ESG risks and potential opportunities in our members’ portfolios. The Investment team integrates ESG criteria throughout their investment processes, applying a sustainable lens to their portfolio allocation decisions, investment strategies, and active ownership practices. This includes exclusionary screens, ESG integration by our managers, impact investing, engagement, and collaboration. See the chart below.

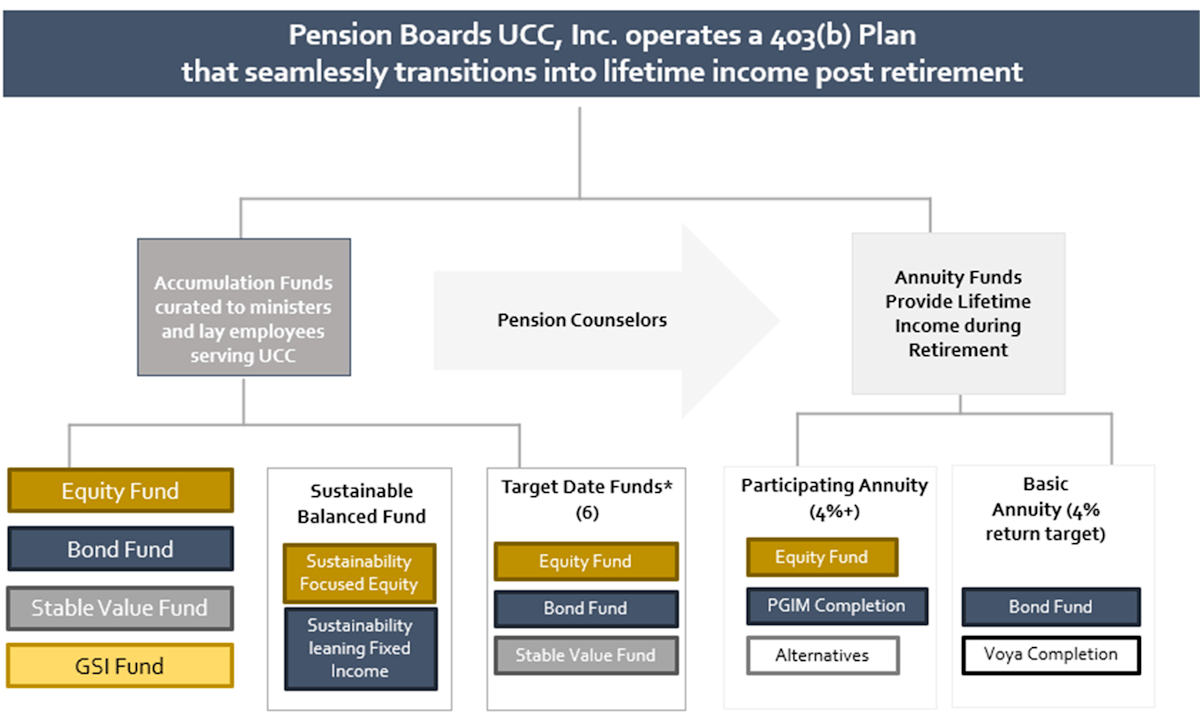

We also offer you eleven curated fund options available during your active phase of employment, which are diversified with top investment managers. Once you move into retirement, we give you the option to pick from two annuity funds (Basic Annuity or Participating Annuity), guaranteeing income for life. All these investment options have faith and finance integrated into its approach, and all managers are currently United Nations Principles for Responsible Investing (UNPRI) signatories.

Since early 2023, we have made some key advancements, including creating a sustainable climate policy and investment policy on Diversity, Equity, Inclusion, and Belonging. We have also committed to follow-on funds of current impact managers in areas of energy transition, human capital management, and modernizing antiquated industries through technology. Below, we have highlighted two of these managers:

Lumos Capital Group

In 2019, we invested in Lumos Capital Group Fund I and recently made a follow-on investment in their Fund II. The portfolio is focused on the human capital development sector with diversified investments across key verticals of K-12, higher education, and workforce development / corporate learning. Additional themes the team may include in Fund II include mental health and special education. The team is dedicated to impact by it being embedded within their investment lifecycle, having an Impact Advisory Council, and annual impact report.

Builders VC Fund

In 2020, we invested in Builders VC Fund II and recently made a follow-on investment in their Fund III. The fund consists of venture investments in key sectors of agriculture, healthcare, industrials, and real assets by providing these antiquated industries with technology solutions. ESG is integrated into their investment process with specific impact measurement and alignment with eight U. N. Sustainable Development Goals (SDGs).

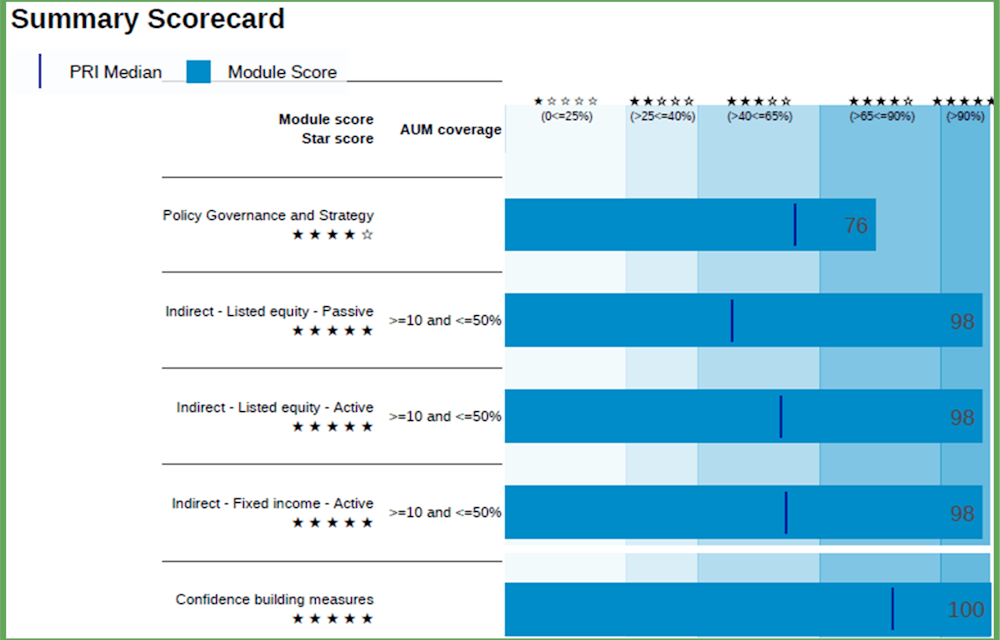

All our work in the area of sustainable investing and engagement can be seen through our strong U.N. Principle for Responsible Investing (UNPRI) results. The UNPRI has over 5,000 institutional investors, both asset managers and asset owners as signatories representing over $120 trillion in assets under management. As fiduciaries, signatories believe ESG issues can impact portfolio performance and align with broader interests of society.

It’s important to note that the Pension Boards scored above the median score in all categories of the 2023 UNPRI report.

Responsible investing aligns financial decisions with UCC values, while potentially contributing to long-term social, environmental and economic stability. By investing in companies that prioritize ESG criteria, together, we contribute to broader societal goals like reducing carbon emissions, advancing human rights, or encouraging corporate responsibility.

For additional information, please view “Why Sustainability Matters,” our 2024-25 Sustainability Report.

Investments with Your Values in Mind

The Pension Boards’ Investment Program aims to provide the highest level of investment performance within the guidelines of the organization and invests assets on behalf of its members for positive impact. We emphasize and support our shared United Church of Christ values such as sacredness of creation, human rights, and underserved and underrepresented populations.

by Minoti Dhanaraj

Minoti Dhanaraj is the Director, Responsible Investments for The Pension Boards-United Church of Christ, Inc. She joined the Investment team at the Pension Boards in 2018. Minoti has over 15 years of experience in the financial services industry, most recently as a Senior Investment Officer at The Employees’ Retirement Fund of the City of Dallas and a Research Analyst at Neuberger Berman. Minoti received her BBA in Finance from the University of Texas at Austin and an MBA from the University of Chicago.

We all agree on the mission—invest the assets held in trust for retirement wisely and prudently, while maximizing the positive impact on climate change, human rights and providing capital to empower those challenged by a lack of economic success.David A. Klassen

Chief Investment Officer at the Pension Boards

RELATED ARTICLES

Corporate Social Responsibility Part 1: Addressing Human Rights, Climate, Social Justice

Holistic Approach to Sustainable Investing

POPULAR RESOURCES

Why Sustainability Matters: 2024-25 Sustainability Report

The Pension Boards' 2024-25 Sustainability Report, themed "Why Sustainability Matters," centralizes on the organizations' commitment to corporate social responsibility and responsible investing by way of its journey and recent advancements in four areas: alignment; integration; impact; and engagement.